Baby boomers: Get ready for a double whammy.

For years now, there's been a lot of talk about boomers getting tremendous windfalls as their parents pass on. Many boomers, in fact, have been lagging behind in their savings, betting on—hoping for—big bequests, especially since many of them suffered big losses in 2008.

But for a growing number of boomers, things aren't going according to plan. The postwar generation is living longer—and many are spending their savings along the way. And, of course, many of them also took a hit in 2008.

The result is that, as a group, boomers likely won't be getting as much of an inheritance as they hoped. Even worse, far from receiving a bequest, a growing number are tapping some of their own savings to help their cash-strapped parents make ends meet.

For families, the result is often a lot of scrambling, dashed dreams, and conflict and angst as parents and children try to come to grips with the lean new reality—and divide up a smaller pie.

"There are way too many adult children I see who are looking at Mom and Dad's estate as their ticket to a secure retirement," says M. Holly Isdale, an estate planner in Bryn Mawr, Pa. "But with people living longer, much of the money is likely to be spent."

How much longer? Thanks to medical gains, a 65-year-old man has a 60% chance of living to age 80 and a 40% chance of reaching 85. For women, the odds are 71% and 53%, respectively. All of this has made the 85-and-over age bracket the fastest-growing segment of the population. In an era of low interest rates, volatile financial markets, and rising costs for health and long-term care, finding money to cover those years isn't always easy.

Consider the case of Nancy Becker, the co-owner of a small business in Waterbury, Conn. Her parents, Morris and Dorothy Stein, were diligent savers. "But they didn't imagine living well into their 90s," says Ms. Becker, whose father died in 2006 at 92 and whose mother died in 2011 at 97.

Ms. Becker and her two brothers inherited a house in Vermont from their father. But they spent about $180,000 of their own money—an amount that exceeds the value of the Vermont property—to cover living expenses for their mother in the final three years of her long life.

Ms. Becker, now 63, says she certainly doesn't begrudge her parents for outliving their savings. The Steins built a thriving plumbing and heating business that now employs Ms. Becker and her husband, among other family members. Still, as Ms. Becker's in-laws enter their 90s, she worries that "their money is running out, too."

Financial losses can also put a dent in the older generation's reserves. Donald Hoeller, 86, of Glendale, Wis., says he and his wife, Bernadette, 85, had hoped to bequeath "several hundred thousand dollars" to each of their six children. But an office complex in which the couple invested 60% of their retirement savings recently landed in foreclosure and litigation.

So, Mr. Hoeller says, "I don't know if they will get anything."

His daughter, Mary Hoeller, 58, says that while she never counted on an inheritance, "times are tough"—and she now has the added worry that her parents may run out of money. A divorcee who is paying college-tuition bills for the youngest of her three children and wants to help another child with medical-school tuition, Ms. Hoeller says her income has declined substantially since 2008.

"I am very frugal," says Ms, Hoeller, a mediator in Indianapolis. But "who wouldn't want an inheritance from their parents? It would be a good thing."

Scaling Back Bequests

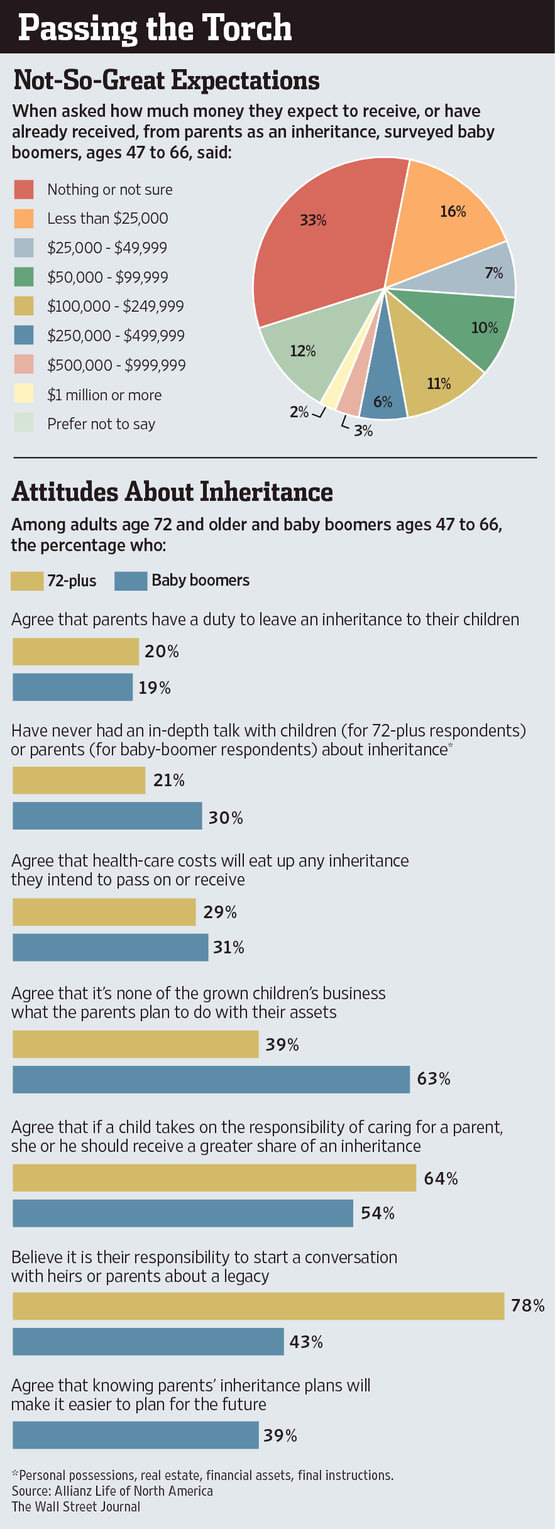

Many parents, of course, won't exhaust their savings. The Center on Wealth and Philanthropy at Boston College estimates that baby boomers and their offspring could inherit as much as $27 trillion over the next four decades, with the progeny of the wealthiest pocketing much of the windfall.

But there are signs that expected bequests are under pressure. According to Boston College's Center for Retirement Research, from June 2006 to June 2010, falling asset values reduced projected inheritances for baby boomers an estimated 13%. Stock prices have since recovered, although house prices in most markets have not.

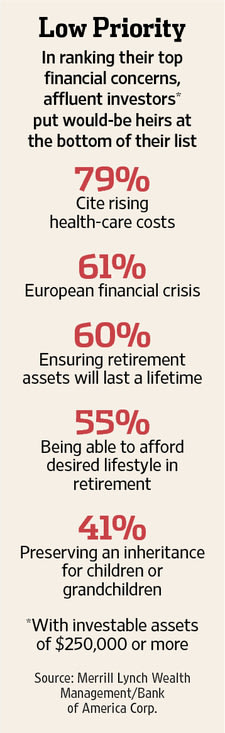

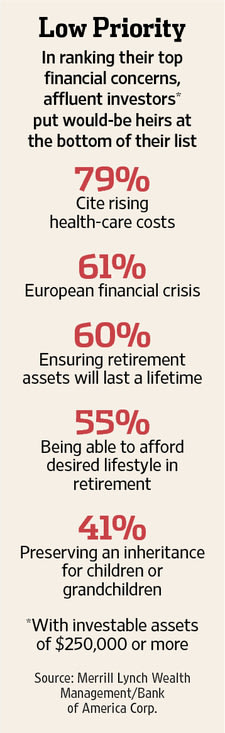

Even the affluent are pulling back. Among those with $250,000 or more in investible assets, only 41% said preserving inheritances was a top concern, down from 54% in 2009, according to a Merrill Lynch survey released earlier this year. Due in large part to a 22% decline in projected future bequests of $500,000 or more, the amount individuals expect to transfer fell by 19% from 2008 to 2009, according to Michael Hurd, director of the Center for the Study of Aging at Rand Corp., a nonprofit research organization.

Just as telling is a recent study from Northwestern Mutual Life Insurance Co. in Milwaukee. When asked how prepared they feel to live to various ages, one in three surveyed adults age 60-plus said they didn't feel prepared financially to live to age 85; almost one in two said the same with regard to age 95.

Suffering in Silence

Not surprisingly, many families are loath to discuss these issues.

In addition to serving as a reminder of the older generation's mortality, a conversation about inheritance or Mom and Dad running out of money can provoke anxiety in parents. Many are uncomfortable disclosing the details of their finances in the first place, even more so when they're worried about disappointing their children.

Adult children, in turn, aren't eager to ask their parents about money for fear of coming across as greedy. Some feel guilty for thinking about their own financial needs at a time when parents could be facing steep medical or long-term-care expenses.

"Due to the new realities of longevity, adult children—who have rightfully assumed they would inherit something substantial from their parents and have lived their lives accordingly—can no longer count on that," says Lillian Rubin, a sociologist, psychologist and author. Adult children, she adds, "often feel guilty for even thinking about" inheritance.

Nonetheless, financial advisers say, it is important for families to talk—if only to establish realistic expectations.

Peter Bell, 59, says he and his parents "have always been very open about talking about finances." That frankness has helped them through some tough choices in the past few years.

Mr. Bell, the president of the National Reverse Mortgage Lenders Association in Washington, D.C., "always assumed" his father, Jerry, 87, and mother, Florence, 88, would leave a substantial inheritance.

After his parents lent his brother money several years ago, Mr. Bell says, they "decided I would get the house and everything else would be split."

But when the elder Bells decided almost two years ago to move into a continuing-care retirement community, it became apparent they would need the proceeds from the sale of their home to finance the community's $425,000 entry fee. Worse, because the depressed Florida real-estate market hindered their efforts to sell their home in Delray Beach, the couple had to borrow the $425,000 entry fee from their son.

"We have always considered our money as family money," says Jerry Bell, who anticipates repaying 85% of the loan from the proceeds of the home's recent sale. "When the kids needed help, we were there for them. And when we needed help, they were there for us."

Measures to Take

If parents anticipate running short of money—and if they and adult children are able to start a dialogue—there are several steps families should consider, financial planners say. Among them: Have parents recalibrate their budgets, downsize to a smaller residence, buy an annuity or longevity insurance to lock in a lifelong income, or take out a reverse mortgage.

In situations where children have adequate financial resources, some advisers recommend the children pay a parent's health-insurance premiums, purchase a long-term-care insurance policy for him or her, give a set amount of money each month or purchase the parent's home to generate cash for living expenses. (Before implementing a strategy, talk with your financial and tax advisers.)

The process can lead to conflict, although the tension typically remains beneath the surface, says Claudia Fine, an executive vice president at SeniorBridge, a New York-based company that provides care-management services.

Very often, she adds, she sees conflict arise over expenditures on caregiving. "Because feelings about inheritance are not expressed, families have a hard time sorting out their differences."

Siblings Sort It Out

Linda Fodrini-Johnson, 67, suspects inheritance calculations play a role in differences she and her three brothers have over managing the finances of their mother, Bernice Bidwell, 90.

Ms. Fodrini-Johnson says she and one brother, 60-year-old Craig Bidwell, "don't need to inherit" from their mother, who recently had a stroke and suffers from congestive heart failure. But disabilities have prevented the other brothers from working in recent years.

"There is tension," says Ms. Fodrini-Johnson, who lives in Walnut Creek, Calif., and runs a company that provides care-management services. "You hear it and feel it, but nobody articulates it because it would be disrespectful to Mom."

She points to a recent disagreement over her mother's hair. She wanted to take her mother to a hairdresser instead of using the one at her mother's assisted-living facility. But other siblings resisted.

No one came out and said it was about the cost, Ms. Fodrini-Johnson says, but that seemed to her to be the motivation. The siblings also debated whether to remodel and rent their mother's San Francisco home—so it could bring in some money—or allow a grandchild to serve as temporary caretaker of the place.

To avoid conflict, Ms. Fodrini-Johnson says, she solicits her brothers' opinions and explains the reasons for her decisions as well as the details of her mother's finances. But as her mother's power of attorney, she has the final say.

Her three brothers declined to comment on the hairstylist incident, or said they didn't know about it. Two brothers, Craig and 63-year-old Gary Bidwell of San Francisco, say they discussed renting their mother's house to bring in extra income to offset her expenses.

No Expectations

When it comes to the idea of an inheritance, the three brothers are of similar minds.

Robin Bidwell, a 59-year-old in Colfax, Calif., says he sustained an injury at age 48 that has prevented him from working. While he receives a pension and Social Security, "I wasn't able to put money away. I don't live the life I want to live, but I don't look to my mother's inheritance to be on top of things," he says. "I believe my mother's care is first and foremost. That, to me, is more important than anything."

"An inheritance would help, but I am not looking forward to it," says his brother Gary, a 63-year-old who retired on a disability pension in 1998. "I don't want an inheritance if I have to lose someone I love."

Like many adult children, the third brother, Craig, says he hopes to receive an inheritance—in his case to help pay for a new home he and his wife plan to build. However, the retiree says he is grateful that his mother is able to afford the high-quality care she receives.

"Whatever my mother has is hers," he says. "It's not my inheritance. I didn't work for it. My brothers didn't work for it. My parents worked for it."

![[UPSIDE]](http://s.wsj.net/public/resources/images/BF-AC916_UPSIDE_D_20120601170603.jpg)

![[panmkt0612]](http://si.wsj.net/public/resources/images/OB-TI232_panmkt_D_20120612081525.jpg) Reuters

Reuters